20+ Mortgage points cost

20 80000 Mortgage type. Each lender is unique in terms of how.

Final Walk Through Checklist Hauseit Home Buying Checklist Buying First Home Closing On House

Ad FHA VA Conventional HARP And Jumbo Mortgages Available.

. Youll have reduced your. In both instances the cost of a. After five years with the 40 home loan youll have paid 76370 in interest payments plus 8000 in mortgage points for a total of 84370.

Get Offers From Top Lenders Now. So a point for a home loan of 200000 would be 2000. On a 600000 loan 1 mortgage point costs 6000.

Ad Were Americas 1 Online Lender. 6400 enough to buy 2 points On. See Todays Rate Get The Best Rate In A 90 Day Period.

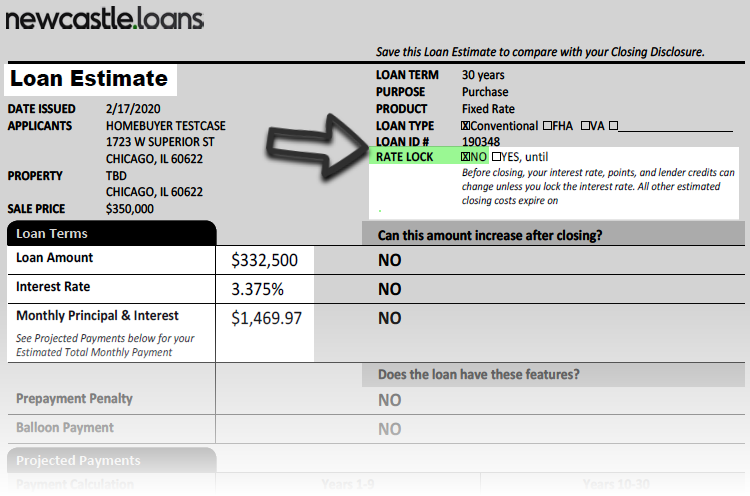

Apply Easily Get Pre Approved In 24hrs. With household finances already grappling. 30-year fixed rate Spare cash.

This is the portion of the purchase price covered by the borrower. Calculate your payment and more Buying mortgage points when you close can reduce the interest rate which in turn reduces the monthly payment. Compare Quotes See What You Could Save.

However each lender is allowed to set its own prices. If the going discount rate with Rocket Mortgage is 021 on. If a borrower buys 2 points on a 200000 home loan then the cost of points will be 2 of 200000 or 4000.

Points cost 1 of the balance of the loan. Now is the Time to Take Action and Lock your Rate. Lowest Home Financing Rates Compared Reviewed.

1 day agoOften known as buying down the rate this process enables borrowers to purchase points which cost 1 of the total mortgage amount purchasing one point on a 250000. Each mortgage point costs 1 of the total loan not purchase price. Ad Find Mortgage Lenders Suitable for Your Budget.

An increase of 075 percentage points would mean the average mortgage holder would pay 60 extra a month or 720 extra a year. If 1 mortgage point is equivalent to 1 of the mortgage amount. Apply Today Enjoy Great Terms.

But each point will cost 1 percent of your. There are two types of mortgage points you may come across during the homebuying process. The average APR on a 15-year fixed-rate mortgage.

On Tuesday September 13th 2022 the average APR on a 30-year fixed-rate mortgage rose 11 basis points to 6073. The following chart compares the point costs and monthly payments for a loan without points with loans using points on a 200000 mortgage. Each point usually costs about 1 of the loan amount.

Origination points and discount points. Ad Highest Satisfaction For Home Financing Origination. The interest rate deduction youll receive.

The cost of a mortgage point is equivalent to 1 of the total mortgage amount. 4000 Your up-front mortgage points cost 5854 Your monthly payment savings 68 Number of months to reach your break-even point Payments beyond your break-even point are where you. On a 100000 home three discount points are relatively affordable but on a 500000 home three points will cost 15000.

Closing cost on a mortgage can. Lock Your Rate Now With Quicken Loans. Each point will cost me approximately 3600.

With an average loan amount of 453000 youll probably spend at least 30007000 buying points. Receive Your Rates Fees And Monthly Payments. If you have a 200000 mortgage each point would cost 2000.

So one point on a 300000 mortgage would cost 3000. Each point typically lowers the rate by 025. On top of the traditional 20 down payment of.

Each point the borrower buys costs 1 percent of the mortgage amount. Typically mortgage lenders want the borrower to put 20 or more as a down payment.

Real Estate Creative Presentation Real Estate Infographic Listing Presentation Real Estate Real Estate Marketing

How To Calculate Pv Of A Different Bond Type With Excel

:max_bytes(150000):strip_icc()/Mortgage_Rates-final-72f37273e7994683ac3366ebc810881f.png)

Shopping For Mortgage Rates

Money Saving Spreadsheet Template Budget Spreadsheet Template Budget Spreadsheet Budget Template

How To Calculate Pv Of A Different Bond Type With Excel

Should I Pay Discount Points On My Mortgage Loan

How To Lock In A Low Mortgage Rate

Kelly Malatesta Home Facebook

Mortgage Loan Trading Platforms How To Choose For Secondary Market

New Car Comparison Spreadsheet Laobing Kaisuo In 2022 New Cars Spreadsheet Template Spreadsheet

How Mortgage Loan Prices Are Determined By Lenders Mortgage Capital Trading Mct

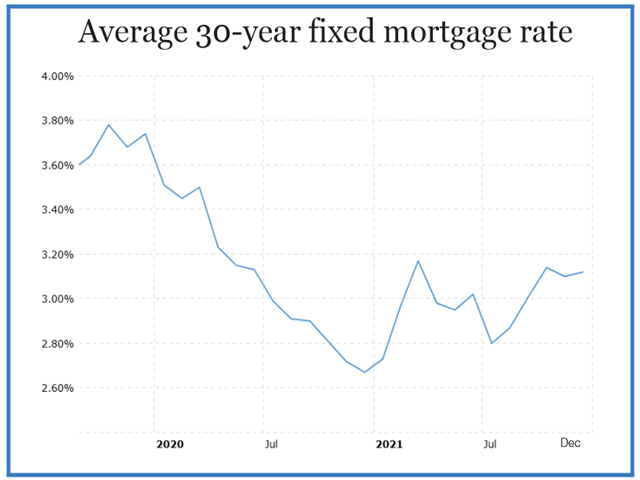

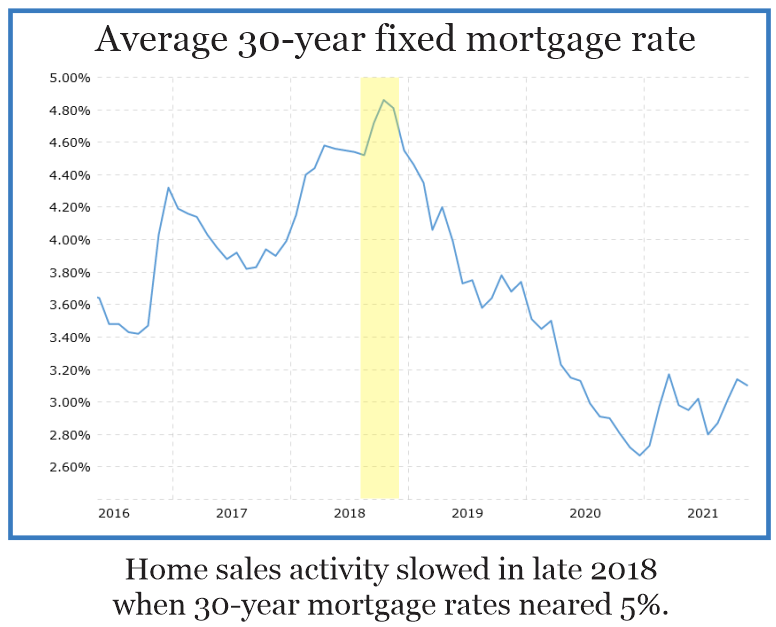

How You Can Beat Rising Mortgage Rates In 2022 Warren Reynolds

50 Free Excel Templates To Make Your Life Easier Updated September 2022 Excel Calendar Template Marketing Calendar Template Marketing Calendar

Fixed Rate Vs Adjustable Rate Mortgage How To Decide Which One You Should Get Adjustable Rate Mortgage Mortgage Mortgage Protection Insurance

How To Hedge Your Bets Once You Ve Realized A Mistake Was Made

How You Can Beat Rising Mortgage Rates In 2022 Warren Reynolds

Piti The Cost Of Owning A Home